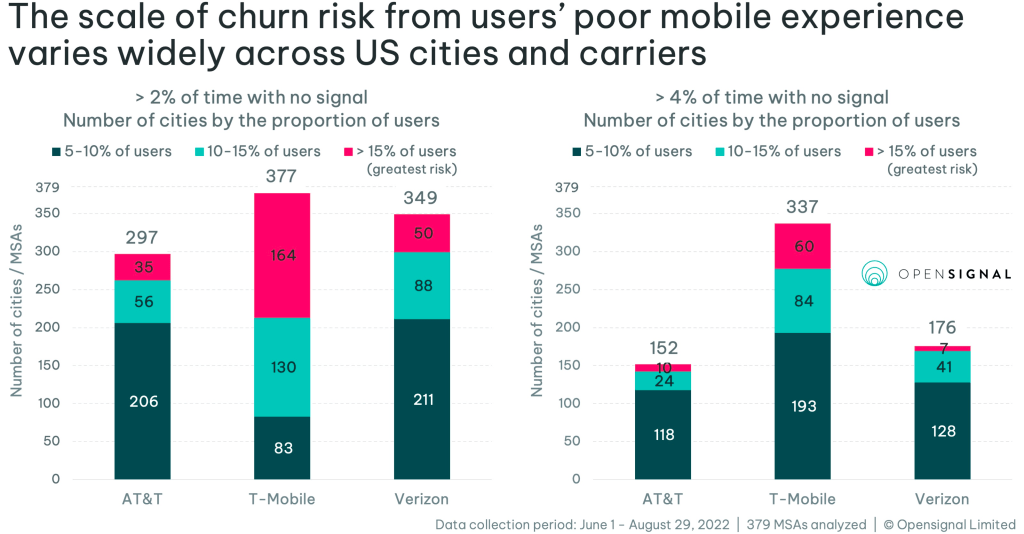

Opensignal data demonstrates there is a strong correlation between users that saw more time spent without cellular signal and relatively worse 5G Availability and those users that switched carrier. This relationship holds true for AT&T and T-Mobile. When we compare the multiplayer gaming experience of Leavers, we see a large difference for T-Mobile, but smaller ones for AT&T and Verizon. On average download speed, both T-Mobile and AT&T Leavers saw significantly slower speeds than the all user average. Read the full analysis here.