Multiple sources now report smartphone shipments have dropped in 2022. The impact of slowing smartphone shipments will be felt far beyond the smartphone market because the smartphone has been at the heart of consumer technology innovation for a decade. For example:

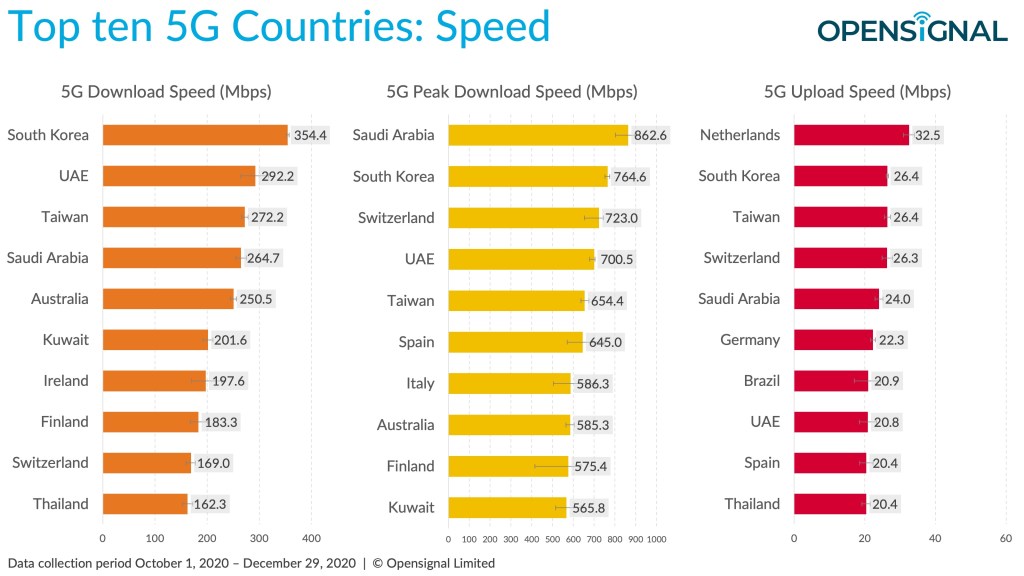

- 5G roll outs will be affected. Mobile operators need consumers to adopt new phones with the latest versions of 5G in order for their network investments to convert into consumer benefits. Newer models support standalone, better carrier aggregation across spectrum bands, and network slicing among other areas. In other words, 2022 smartphone models support the newer features of 3GPP Release 16 and 17 while models from just a couple of years ago only support early Release 15 standard 5G capabilities.

- App makers will have to support older Android versions for longer. Among Android smartphones, users typically switch to the latest Android version when they buy a new phone. Most phone models older than three years never see an upgrade. So, if the smartphone market slows, so will the number of users that have a phone using a recent Android version and any app developers that need a new Android feature to be widely adopted will need to wait longer.

- Adjacent market innovation will slow. The enormous scale of the smartphone market has enabled companies to re-use technologies developed first for the smartphone in other markets. If the smartphone market shrinks, there will be less of this adjacent innovation. Past examples include ARM system on a chips that now power the latest smartwatches, VR headsets, Mac and Windows computers, and threaten x86’s position in the data center.

Many services, apps, and other hardware products rely on the pace of smartphone upgrades to push new technologies into mass market adoption. By comparison, other product categories that have had much slower upgrade cycles — TVs, PCs, cars, etc. — take years longer than the smartphone for any new innovation to reach a critical mass of users.

There’s an expectation among many in the mobile industry that it will be as resilient to economic slowdown now as it was slightly over a decade ago after the financial crisis of 2008/9. But the economic stresses the world faces now will likely accelerate the current slowdown in shipments, because the market is not the same now as it was then:

- Consumers are no longer buying their first modern smartphone, they already have one that works well. Then the smartphone market was recession-proof as consumers prioritized buying one of the then new generation smartphones over other spending because of the appeal of the new Apple and Android smartphones with their desktop-quality apps and multitouch user interfaces which were a massive jump forward over their existing dumb phones. Now, the choice for a consumer is whether to switch to a marginally better 2022 model or to hold onto the still very capable model they own and that still works fine.

- Smartphone makers have already taken steps to stem the effect of lengthening upgrade cycles. Over the last few years smartphone makers have made their premium smartphone models more expensive as the market matured. Their thinking is that if consumers buy a new phone less often, but spend more when they do, then they can maintain their revenue and profit levels. With disposable incomes falling due to much higher energy prices and double digit inflation this tactic will no longer work. Many consumers will either upgrade their smartphone less often, or spend less when they do, or likely both.

There are some positives to take, notably around the environment: If users hold onto their devices for longer then they will expect to be able to be able to repair their devices, and manufacturers will need to adapt to support existing users for longer. As a result, carbon emissions from manufacturing will be amortized over a longer time.

There is still plenty of innovation in the market too. Foldables are an attractive and interesting category that have only recently become compelling. Camera innovation is still moving fast. And, augmented reality is still a tantalizing prospect that is a niche held back by current technology, but will not be for much longer. Yet none of these have the compelling mass appeal of Android and Apple smartphones back in 2008/9. Those looking to innovate now with bold product launches must pick their market timing even more carefully than normal.

What’s clear now is that the world’s economy is slowing dramatically. Energy costs are rising. And, anyone assuming that the mobile market will be as resilient this time as it was in previous economic downturns must think through their assumptions. And, the role of the smartphone in the wider technology market means slowdowns in smartphone shipments will have wide impacts and likely unexpected collateral damage.